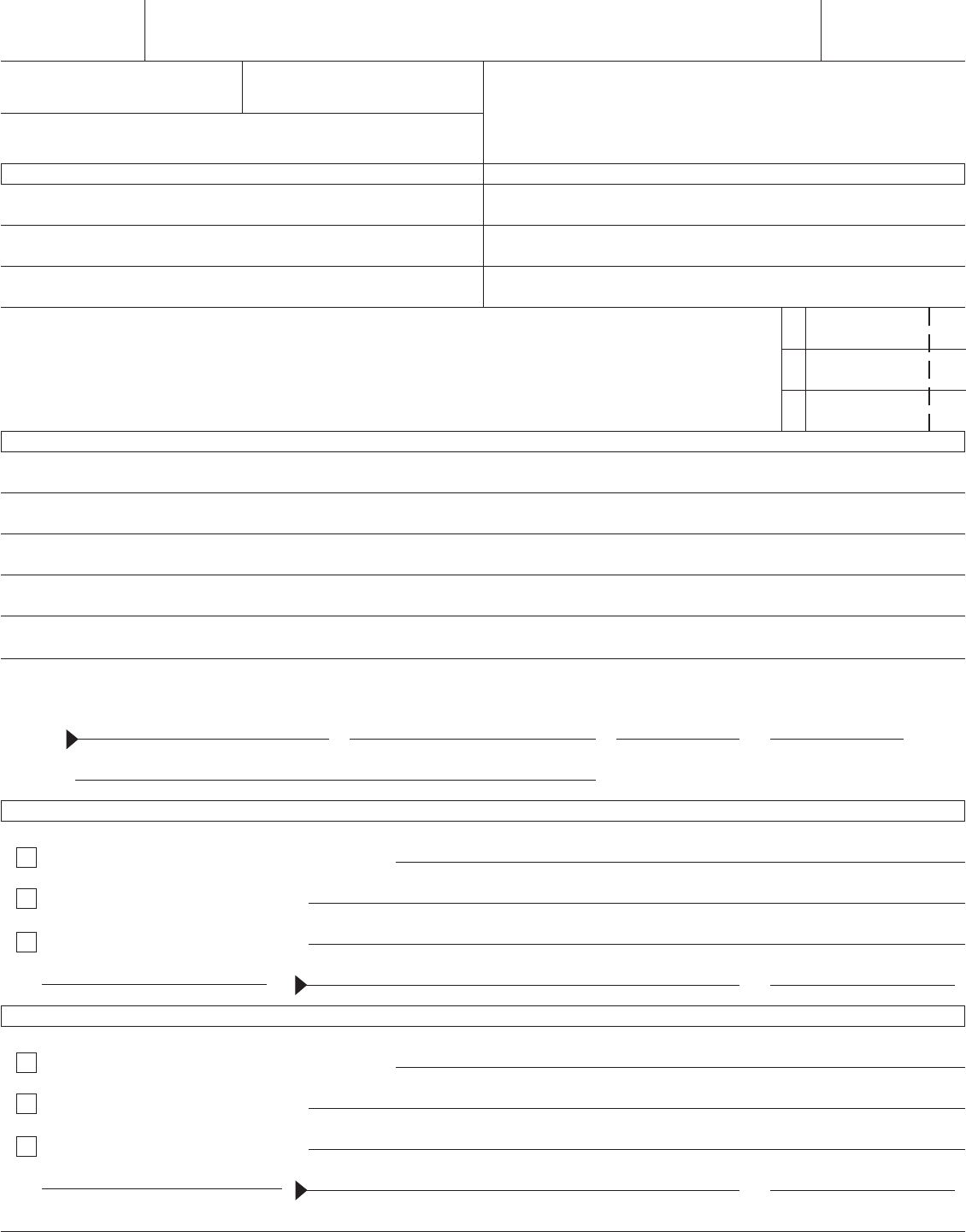

Signature of Claimant Title Date Telephone

Claimant’s Email Addresss

FORM

53

A copy of the check or other proof of payment must be attached to this claim.

Under penalties of law, I declare that I have examined this claim, and that it is, to the best of my knowledge and belief, true, complete, and correct.

I further certify that I took financial responsibility for the payment of the amount stated above and I was not reimbursed or credited in any manner.

Nebraska Refund Claim

for Documentary Stamp Tax

• Attach a copy of the recorded deed.

1 Total amount of documentary stamp tax originally paid ............................................................................... 1

2 Amount of documentary stamp tax claimed to be due ................................................................................. 2

3 Net amount of documentary stamp tax refund claimed (line 1 minus line 2) ............................................... 3

sign

here

Authorized by Neb. Rev. Stat. § 76-908 (2009) 5-148-1981 Rev. 7-2021 Supersedes 5-148-1981 Rev. 8-2016

County Recorded Date Recorded Legal Description

Recording Data – Instrument Number

Register of Deeds’ Name and Mailing Address Claimant’s Name and Mailing Address

Name Name

Street or Other Mailing Address Street or Other Mailing Address

City State Zip Code City State Zip Code

Basis for Refund Claim of Documentary Stamp Tax

For County Register of Deeds’ Recommendation Only

For Nebraska Department of Revenue Use Only

Comments:

Approval Recommended

Approval Recommended as

Revised, See Comments

Denial Recommended

Date Received

Signature of Register of Deeds Date

Comments:

Approved

Approved As Revised,

See Comments

Denied

Date Received

Authorized Signature Date

File With the

County Register

of Deeds

RESET

PRINT

Instructions

Who May File. Any person paying the documentary stamp tax imposed by Neb. Rev. Stat. § 76-901 may le a claim

for refund if the payment was: (1) the result of a misunderstanding or honest mistake of the taxpayer; (2) the result of

a clerical error on the part of the register of deeds or the taxpayer; or (3) invalid for any reason.

When to File. A claim for refund of documentary stamp tax must be made within two years of payment. The claim

for refund must be made on this form. Attach a copy of the recorded deed and proof of payment. If the claim for

refund is based upon an exemption listed in Neb. Rev. Stat. § 76-902, state the statute subsection number and reason

for the refund claim. Copies of any supporting documents should be attached to this form.

Where to File. This form must be led in the ofce of the county register of deeds where the tax was paid.

County Register of Deeds and Tax Commissioner Procedures for Review of Refund Claim. The register of

deeds must, within 30 days, make a recommendation of either approved, approved as revised, or denied. A copy of

the recommendation, together with a copy of the claim, a copy of the Real Estate Transfer Statement, Form 521, and

the documentation, must be led with the Tax Commissioner. Please mail a copy of the required documents along

with the register of deeds recommendation to the Nebraska Department of Revenue, PO Box 98919, Lincoln NE

68509-8919. Within 30 days after receiving the recommendation, the Tax Commissioner must approve or deny the

claim for refund in whole or in part. A copy of the decision of the Tax Commissioner will be mailed to the register of

deeds and to the claimant’s address within ten days after the decision is rendered. If a refund is approved by the Tax

Commissioner of all or a portion of the documentary stamp tax paid, the register of deeds is authorized to make the

refund from the currently collected documentary stamp tax funds in the ofce of the register of deeds.

Appeal Procedure. A taxpayer denied a claim for refund, in whole or in part, may appeal the decision of the Tax

Commissioner within 30 days to the Lancaster County District Court.

Specic Line Instructions

Line 1. Enter the total amount of documentary stamp tax originally paid by the claimant. Attach a copy of the recorded

deed and proof of payment of the documentary stamp tax, such as copies of receipts or canceled checks.

Line 2. Enter the amount of documentary stamp tax you believe is due (if zero, enter zero). Provide the basis for this

amount in the area provided. Attach any supporting documents substantiating this amount.

Line 3. Enter the amount of documentary stamp tax refund claimed.