The International Accounting Standards Board is the independent standard

-setting body of the IFRS Foundation, a not-for-profit corporation promoting the

adoption of International Financial Reporting Standards. For more information visit

www.ifrs.org.

Page 1 of 9

Agenda ref

21C

STAFF PAPER

July 2019

IASB

®

meeting

Project

Primary Financial Statements

Paper topic

Classification of interest and dividends in the statement of cash

flows

CONTACT(S)

Kensuke Okabe

kokabe@ifrs.org

+44 (0) 20 7246 6439

Aida Vatrenjak

avatrenja[email protected]g

+44 (0) 20 7246 6456

This paper has been prepared for discussion at a public meeting of the International Accounting Standards

Board (Board) and does not represent the views of the Board or any individual member of the Board.

Comments on the application of IFRS

®

Standards do not purport to set out acceptable or unacceptable

application of IFRS Standards. Technical decisions are made in public and reported in IASB

®

Update.

Purpose of this paper

1. At its December 2017 and February 2019 meetings, the Board made tentative

decisions about the classification of interest and dividends in the statement of cash

flows. At its February 2019 meeting, one Board member made an alternative

suggestion about the classification of these cash flows which some other Board

members suggested the staff should explore. This paper analyses this suggestion and

discusses whether the Board should amend its tentative decisions.

Staff recommendation

2. The staff recommend that the Board retain its tentative decisions regarding the

classification of interest and dividends in the statement of cash flows without

amendment.

Structure of this paper

3. This paper is structured as follows:

(a) Background (paragraphs 4–17); and

(b) Staff analysis and recommendation (paragraphs 18–22)

Agenda ref 21C

Primary Financial Statements │Classification of interest and dividends in the statement of cash flows

Page 2 of 9

(c) Appendix A— summary of classification of interest and dividends

Background

Current IFRS requirements

4. Paragraph 6 of IAS 7 Statement of Cash Flows defines the following activities:

(a) operating activities are the principal revenue-producing activities of the

entity and other activities that are not investing or financing activities;

(b) investing activities are the acquisition and disposal of long-term assets and

other investments not included in cash equivalents; and

(c) financing activities are activities that result in changes in the size and

composition of the contributed equity and borrowings of the entity.

5. Paragraph 14 of IAS 7 states that cash flows from operating activities generally result

from the transactions and other events that enter into the determination of profit or

loss.

6. Paragraph 33 of IAS 7 states that interest paid and interest and dividends received are

normally classified as operating cash flows by a financial institution. However, there

is no consensus on the classification of cash flows for non-financial entities and IAS 7

allows the following classifications.

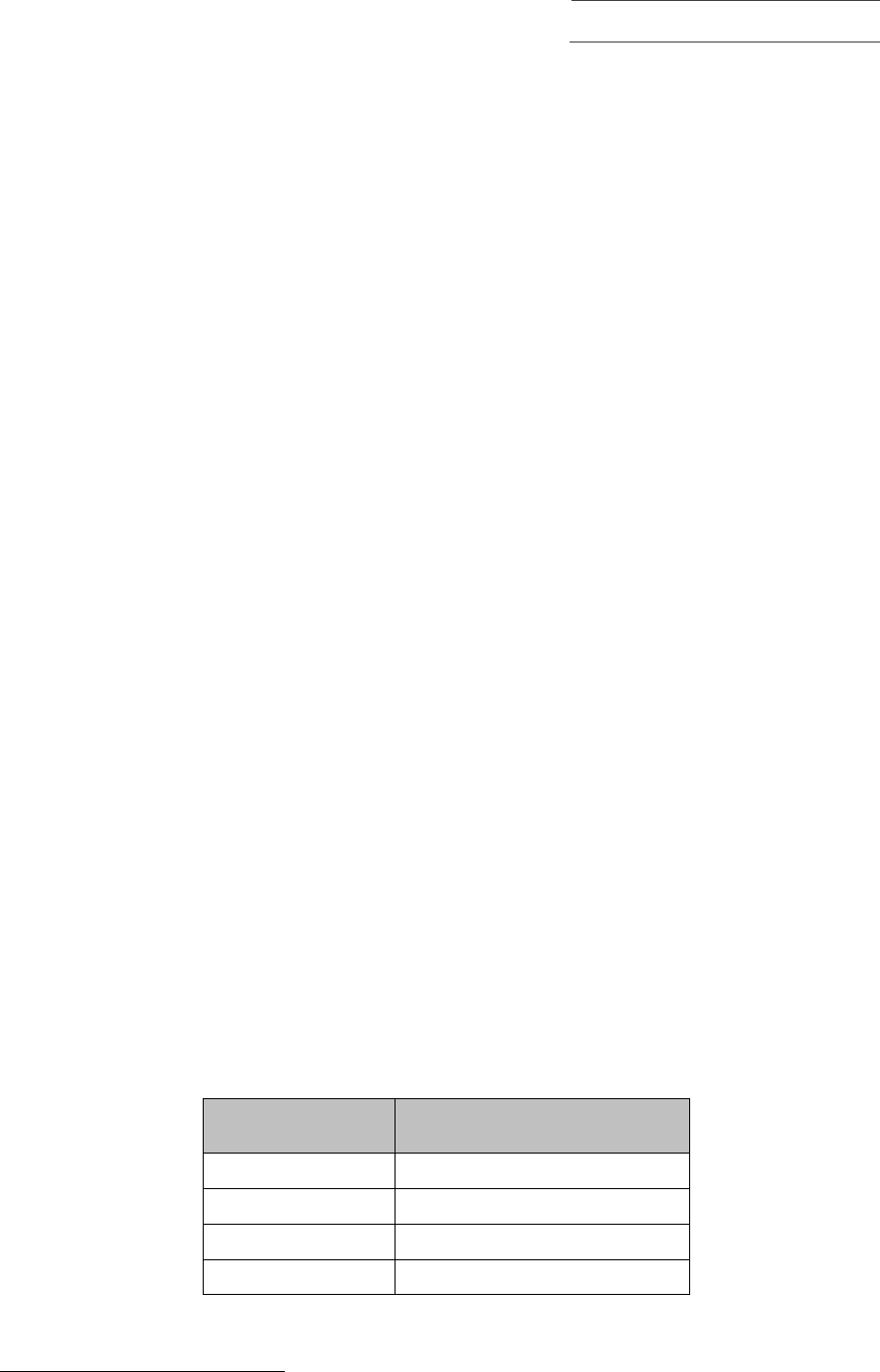

Table 1: Classification for non-financial entities applying IAS 7

Cash flow item

Classification allowed by IAS 7

Interest paid

Operating or Financing

Dividends paid

Operating or Financing

Interest received

Operating or Investing

Dividends received

Operating or Investing

Scope of the project and the Board’s tentative decisions for the statement of

cash flows

7. Regarding the statement of cash flows, the Board is proposing:

(a) to eliminate options for the classification of the cash flows from interest and

dividends (see paragraphs 10–14); and

Agenda ref 21C

Primary Financial Statements │Classification of interest and dividends in the statement of cash flows

Page 3 of 9

(b) to require entities to use the operating profit subtotal as the starting point

for the indirect reconciliation of cash flows from operating activities.

8. The Board is not proposing to:

(a) seek full alignment between the operating section of the statement of cash

flows and the corresponding sections in the statement(s) of financial

performance; or

(b) make further improvements to the statement of cash flows, besides those

mentioned above.

9. At its November 2017 meeting

1

, the Board tentatively decided to clarify the definition

of ‘financing activities’ in IAS 7 (see paragraph 4(c)) by indicating that a financing

activity involves:

(a) the receipt or use of a resource from a provider of finance (or provision of

credit).

(b) the expectation that the resource will be returned to the provider of finance.

(c) the expectation that the provider of finance will be appropriately

compensated through the payment of a finance charge. The finance charge

is dependent on both the amount of the credit and its duration.

Classification of dividends and interest for non-financial entities

10. At its December 2017 meeting, the Board tentatively decided to remove the

classification options for interest and dividends (see Table 1) for non-financial entities

and require the classifications shown in Table 2.

2

Table 2: Classification for non-financial entities applying the tentative decisions

Cash flow item

Classification per Board’s

tentative decisions

Interest paid

Financing

Dividends paid

Financing

Interest received

Investing

Dividends received

Investing

1

https://www.ifrs.org/news-and-events/updates/iasb-updates/november-2017/

2

https://www.ifrs.org/news-and-events/updates/iasb-updates/december-2017/

Agenda ref 21C

Primary Financial Statements │Classification of interest and dividends in the statement of cash flows

Page 4 of 9

11. This tentative decision:

(a) requires entities to classify each type of cash flow (dividends paid,

dividends received, interest paid and interest received) in a single section of

the statement of cash flows; and

(b) results in a classification in the statement of cash flows that is generally

consistent with the classification of the related income or expense in the

statement(s) of financial performance.

Classification of interest and dividends for financial entities

12. At its February 2019 meeting, the Board discussed whether the classification for non-

financial entities in Table 2 should be applied to financial entities.

3

The Board noted

that the proposed approach to classification for non-financial entities could not be

applied to financial entities without modification. This is because such an approach

would result in cash flows that are clearly operating in nature being classified as

investing or financing (for example, interest paid would be classified as financing by a

bank).

13. The Board therefore decided to propose an approach for financial entities that would

result in the outcomes described in paragraph 11. Applying this approach, financial

entities will apply the following guidance to determine the classification of their

interest and dividends cash flows:

(a) if the entity presents related income or expenses in a single section of the

statement(s) of financial performance, the entity shall present related cash

flows in that section; or

(b) if the entity presents related income or expenses in more than one section of

the statement(s) of financial performance, the entity shall make an

accounting policy choice regarding the section of the statement of cash

flows in which to present related cash flows.

3

By financial entities we mean entities that provide financing to customers as a main business activity and/or

invest in the course of their main business activities in assets that generate a return individually and largely

independently of other resources held by the entity.

Agenda ref 21C

Primary Financial Statements │Classification of interest and dividends in the statement of cash flows

Page 5 of 9

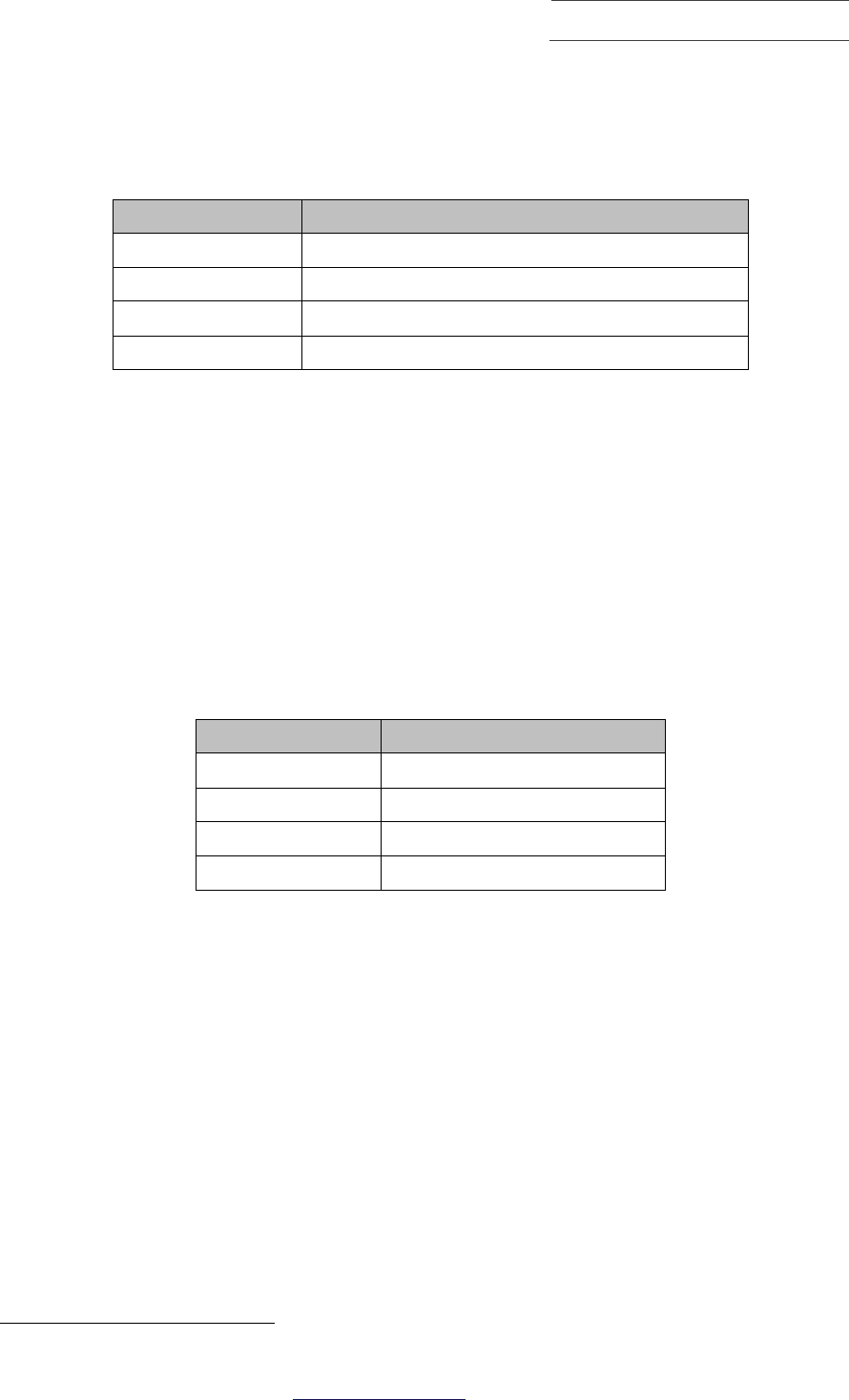

14. Consequently, financial entities would classify their interest and dividends cash flows

as shown in Table 3.

4

Table 3: Classification for financial entities applying the tentative decisions

5

Cash flow item

Classification per Board’s tentative decisions

Interest paid

Operating or Financing

Dividends paid

Financing

Interest received

Operating, Investing or Financing

Dividends received

Operating or Investing

Alternative approach

15. At the February 2019 meeting, one Board member suggested that both financial

entities and non-financial entities should classify dividends received, interest paid and

interest received as operating cash flows (dividends paid would remain classified as

financing cash flows). Table 4 presents the classification of cash flows applying this

approach.

Table 4: Suggested alternative classification for all entities

Cash flow item

Classification

Interest paid

Operating

Dividends paid

Financing

Interest received

Operating

Dividends received

Operating

16. The Board member suggested this approach because it would:

(a) be consistent with the Board’s objective of eliminating options for the

classification of interest and dividends cash flows (see paragraph 7(a));

(b) reduce complexity in preparing the statement of cash flows; and

(c) improve comparability between entities applying IFRS Standards and

entities applying US GAAP.

4

https://www.ifrs.org/news-and-events/updates/iasb-updates/february-2019/

5

Refer to Variant 2 of Approach B of AP21B February 2019

Agenda ref 21C

Primary Financial Statements │Classification of interest and dividends in the statement of cash flows

Page 6 of 9

17. This approach was not included in the staff paper nor was discussed in detail at the

February 2019 Board meeting. However, a few of Board members asked staff to

consider this approach.

Staff analysis and recommendation

Advantages of the alternative approach

18. As with the Board’s proposed approach, the alternative approach described in

paragraph 15 would achieve the Board’s objective of eliminating options for the

classification of interest and dividends cash flows. This will reduce diversity in

practice making users’ analysis of the statement of cash flows simpler and less

costly—users would not need to identify where in the statement of cash flows interest

and dividends cash flows have been classified.

19. Additional advantages of the alternative approach are that:

(a) it would be simpler for preparers to apply and easier for users to understand

than the Board’s proposed approach.

(b) it would be consistent with the approach to classifying operating cash flows

described in paragraph 14 of IAS 7 (see paragraph 5) because dividends

received, interest paid and interest received generally result from

transactions and other events that enter into the determination of profit or

loss.

(c) it would be less costly for preparers to apply because:

(i) they would not need to determine how to classify these cash

flows; and

(ii) for many entities this approach would not result in a change to

existing practice (our analysis of 85 financial statements of

non-financial entities shows that many entities classify cash

flows from dividends received, interest paid and interest

received in the operating section (see Appendix A)).

(d) it would be consistent with US GAAP which generally requires dividends

received, interest paid and interest received to be classified as operating

Agenda ref 21C

Primary Financial Statements │Classification of interest and dividends in the statement of cash flows

Page 7 of 9

cash flows.

6

Consequently, this approach would help users compare entities

that apply US GAAP with entities that apply IFRS Standards.

Disadvantages of the alternative approach

20. The alternative approach has the following disadvantages:

(a) it is arguably inconsistent with the definition of operating activities in

paragraph 6 of IAS 7 (see paragraph 4). This is because, for non-financial

entities, interest paid generally would not arise from the entity’s main

revenue-producing activities but would meet the definition of financing

activities—cash flows from interest paid represent the compensation that an

entity pays to the provider of finance. Whilst we could consider changing

the definition of operating cash flows, this might go beyond the scope of

this project (see paragraph 8(b)).

(b) if the Board were to change the definition of operating cash flows as

suggested in paragraph 20(a), this would result in less alignment between

the operating profit section of the statement(s) of financial performance and

the operating cash flows section of the statement of cash flows than the

Board’s proposed approach. We acknowledge that the Board has tentatively

decided not to seek full alignment between the statements (see paragraph

8(a)). However, we think that where alignment can be achieved it can

increase the understandability of the resulting information.

(c) if operating cash flows include cash flows arising from income and

expenses not included in operating profit, it may seem counter-intuitive to

require operating profit as a starting point for the indirect reconciliation of

operating cash flows. Entities will need to present additional line items in

the operating cash flows section for interest and dividends cash flows.

6

US GAAP stipulates that:

1. cash receipts from returns on loans, other debt instruments of other entities, and equity securities -

interest and dividends are cash inflows from operating activities (ASC 230-10-45-16(b)); and

2. cash payments to lenders and other creditors for interest are cash flows from operating activities (ASC

230-10-45-17(d)).

Agenda ref 21C

Primary Financial Statements │Classification of interest and dividends in the statement of cash flows

Page 8 of 9

Staff recommendation

21. Whilst the alternative approach has significant advantages, we think it would require

amendments to the definition of operating activities in IAS 7 which would be a

fundamental change that could have unintended consequences. It would also be

contrary to the Board’s decision to make limited changes to IAS 7. Furthermore, it

would be inconsistent with the Board’s proposed definition of operating profit to

define cash flows from operating activities such that they include cash flows from

income and expenses not included in operating profit.

22. We therefore recommend that the Board retain the current tentative decisions

regarding the classification of interest and dividends in the statement of cash flows.

We propose to describe the alternative approach and the reasons for rejecting it in the

Basis for Conclusions on the Exposure Draft.

Question

Does the Board agree to retain its tentative decisions regarding the

classification of interest and dividends in the statement of cash flows without

amendment?

Agenda ref 21C

Primary Financial Statements │ Classification of interest and dividends in the statement of cash flows

Page 9 of 9

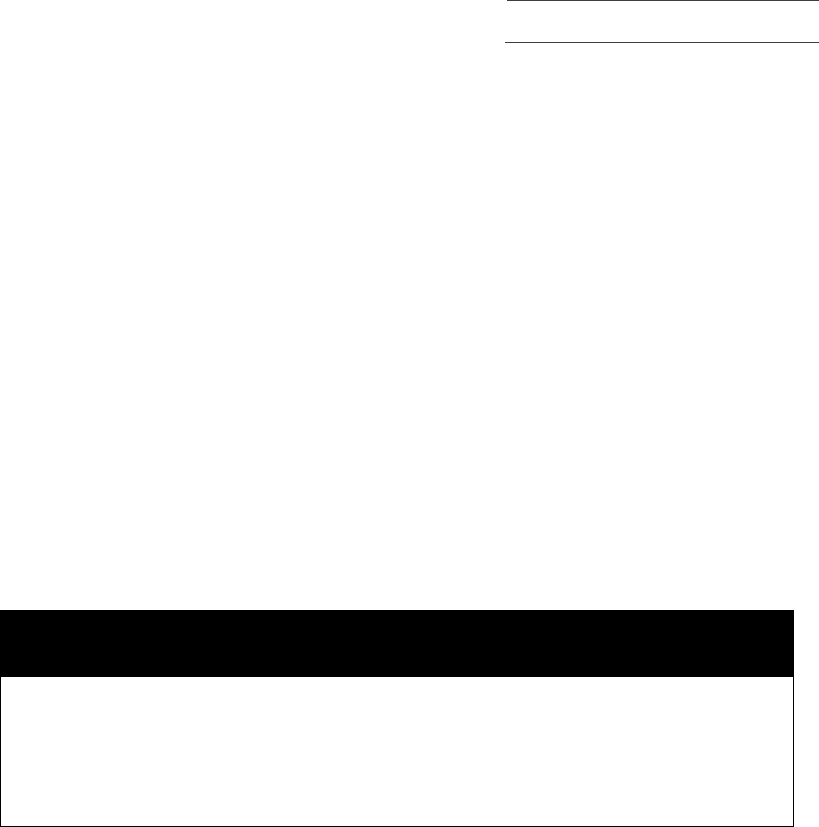

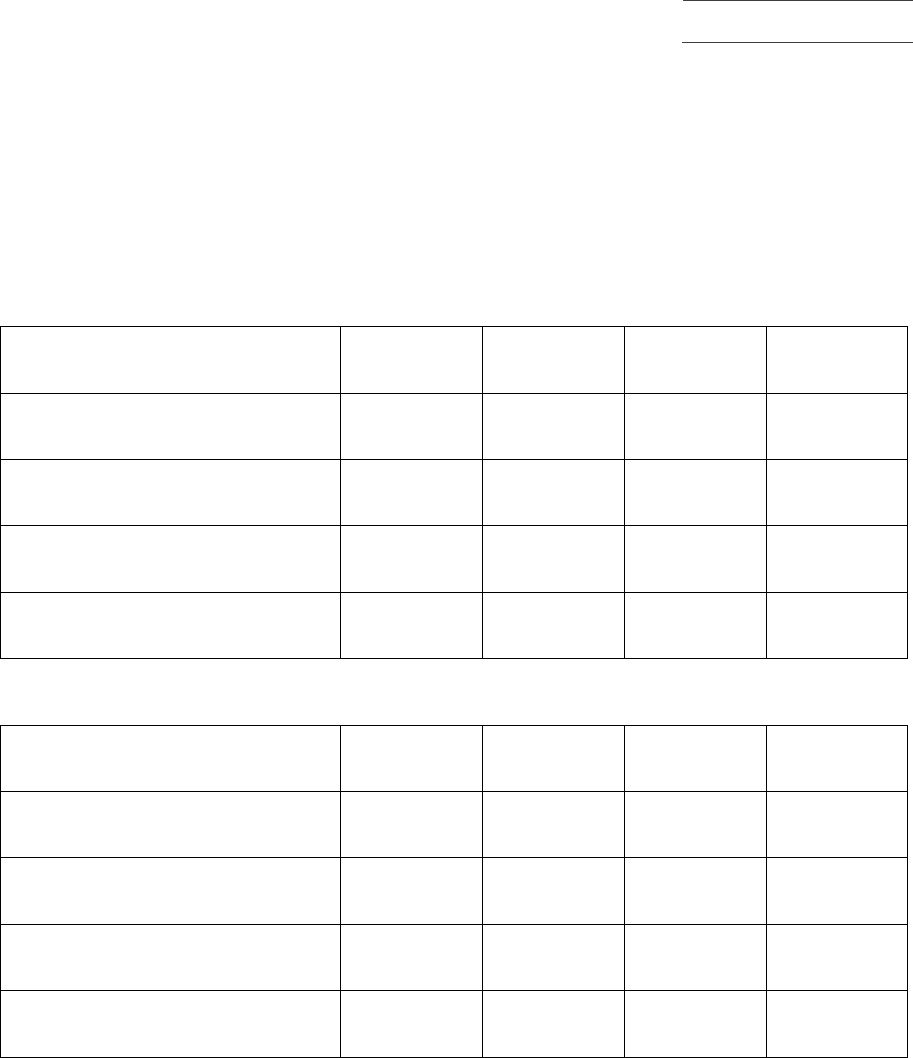

Appendix A— summary of classification of interest and dividends

A1. We have analysed how entities classify interest and dividends in the statement of cash

flows, using a sample of 85 non-financial entities and a sample of 15 financial

entities. The results of this analysis are shown in the following tables:

Non-financial entities

Operating Investing Financing Not clear

Interest paid 51 0 31 3

Interest received 47 29 1 8

Dividends paid 2 0 78 5

Dividends received 32 38 0 15

Financial entities

Operating Investing Financing Not clear

Interest paid 8 0 3 4

Interest received 9 1 0 5

Dividends paid 1 0 11 3

Dividends received 6 3 0 6